Much like Bill Murray stopping his alarm for the final time in the May 1993 cult movie, Groundhog Day, it seems the day is near (schools partially restart on June 1st in England) when we will emerge from the Covid-19 lockdown and embrace the new world. While that movie had a happy ending, in the near to medium term I am not so sure about equity markets as they emerge from their own version of Groundhog Day. This is a more detailed note than average so let me summarize first and then explain in detail.

Key points

a) Recovery post any medical condition like coma or stroke (to the brain or the heart) takes time. The global economy is unlikely to be different. A long journey of recovery, rehabilitation and therapy lies ahead. Prepare accordingly.

b) Given the strong rebound in equity markets, I am cautious (vs. my positioning in March and April) and prefer to wait and watch until a better price or more information (many questions remain unanswered) is available to improve the risk/reward and margin of safety.

c) For financial markets, the most important question (in my humble opinion) is no longer when the vaccine for Covid-19 will be available but the magnitude of impairment to the health and spending power of the US (and global) consumer?

d) ‘Better than expected’ 1Q2020 earnings have lulled the markets into complacency.

e) Based on our analysis of value chains, consensus earnings estimates for both 2H2020 and FY2021 still seem too high. Consensus is not appropriately factoring the following:

- The US consumer remains the key engine of growth for this cycle and if this engine is sputtering due to unemployment (see iii. below), revenue estimates for companies around the world are too high.

- The increased cost of reopening (as we saw with Amazon) means margin expectations in the near term are too high.

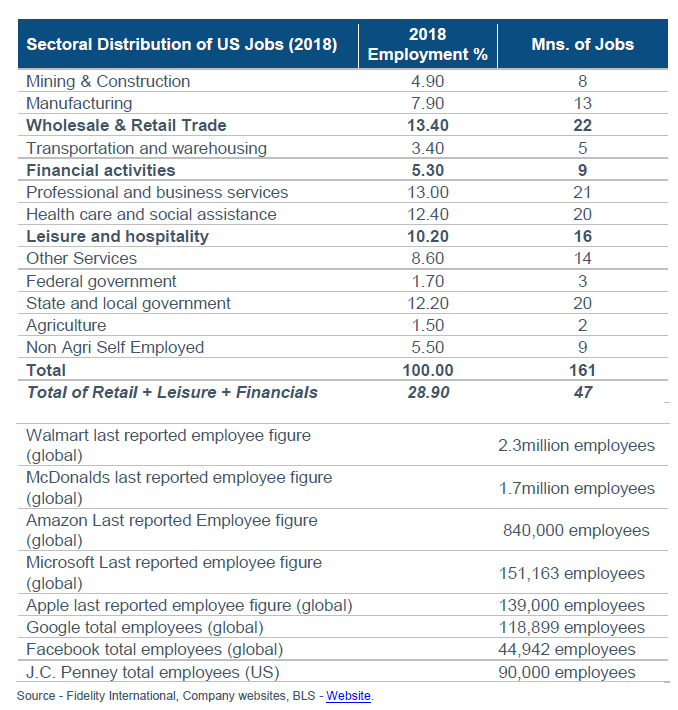

- Employment job losses in key Covid hit sectors (47 million US jobs in travel, financials & retail - JC Penny which filed for bankruptcy this weekend has 2X the employees of Facebook) likely to reverberate as a second and third wave through the economy.

- Revenue growth, operating leverage and financial leverage (increased cost of recent debt issuance for many, plus increased shares outstanding on the convertible issuance) suggest that earnings expectations still have significant downside.

f) Spend time understanding the concept of duration in the value chains you are analysing. This will provide an analytical edge.

g) Watch the walk of the CFOs not the talk - Walk is much more cautious than talk and the reflexive impact of the caution is still to be felt on discretionary spends. In the medium term, nearly every item of spend below gross profits is discretionary. This is especially critical for the technology sector as most tech spend is ultimately discretionary and anecdotally, CEOs are uniformly happy (and indeed pleasantly surprised) about how well their companies and employees have navigated work from home.

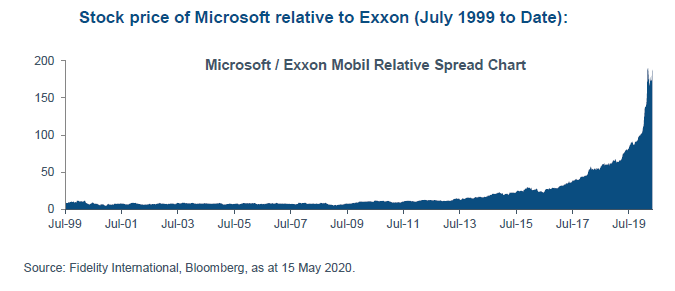

h) Yes, data is the new oil and software is eating the world but looking at the relative performance of Exxon v/s Microsoft, who isn’t already positioned for that?

i) Oil demand remains the best real time indicator of how strongly we emerge from this period.

j) Uncertainty is higher, not lower once we reopen; while central banks can solve for liquidity, solving for solvency is much tougher. Further, some liquidity might exit the financial markets to reliquify the real economy (which is what it was intended for). Articulating intent (strategy) is easy, execution is much tougher (I am acutely aware of this on a daily basis as I try to position the portfolio).

k) Key financial stocks making new lows (below March 2020 levels) require a pause for thought. Sustainable economic recoveries are not possible without financial conditions loosening (they are tightening currently).

l) It may feel like China has had a good crisis so far (see the Economist cover this week). However, the pain lies ahead as i) the reverberations from the developed market lockdown impact orders for the factory of the world ii) trade wars escalate due to US elections. In the same way that Alan Greenspan watched Parker Hannifin for a real time sense of the US economy, watch the relative performance of Apple to get a sense of the seriousness of the trade issues and the health of the technology supply chain.

m) Given the complexity of the problems that lie ahead, for now, everyone (central banker to CEO to CFO) is only speculating. Machines don’t have the data and humans don’t have the compute power to navigate this. We can only adjust in real time while continuing to think about the long-term implications of these changes.

n) Remain flexible

Now on to the details...

In our note dated April 6th ‘The Three Buckets Battle Plan’, we elucidated on the three phases of this market and the need to analyse any complex problem by breaking it up into smaller decisions. As we exit Phase 1 (the virus lockdown phase) we enter Phase II, the toughest phase, where we come face to face with the recession post the virus. The patient is being brought out of the medically induced coma, central bank actions (read liquidity morphine) have kept him alive but now we must look at all the long-term ramifications that follow any medical coma.

Recovery post any medical condition like coma or stroke (to the brain or the heart) takes time. Looking at the economy and the financial markets, in spite of the high competence of the doctors at hand (central bankers) I cannot but feel a similar sense of foreboding for the long journey of recovery, rehabilitation and therapy that lies ahead.

As things stand (on the weekend of 16th May 2020), my sense is that given the duration of this lockdown and the trauma so far to the system globally, the pace of the recovery of the financial markets means they now discount a much faster return to normal than I expect.

The margin of safety, given the strong performance of the lows, (with the Nasdaq now up on the year, the S&P 500 down only 11% year to date (YTD)), is not exciting.

Here are a few reasons for my caution:

a) Covid-19 & Second Waves - I am fully supportive of opening the economy as the economic cost of the lockdown continues to increase. However, as we have seen in Singapore, reopening does lead to a recurrence of the virus. Closure was a political decision - Sweden chose not to do it, India chose the most draconian version. This means that estimating (i) the recurrence/second wave post reopening and (ii) the political reaction function to it creates further uncertainty.

b) Liquidity, Solvency & Reopening - Many commentators have been surprised by the performance of the financial markets in an environment when the real economy was essentially shut. Narratives continue to be constructed to explain what’s happening. My own pet theory is that when unprecedented liquidity was injected into the financial markets by the FED, the money had nowhere to go (as the economy was essentially shut) and it found its way into financial markets.

As we start reopening, this liquidity will exit the financial markets and make its way into the real economy (for which the Fed intended this liquidity in the first place). Further, the true extent of the solvency problem will be apparent only once we reopen. Liquidity is under central bank control - however solvency (ability to pay off debt and interest cost) depends on the revenue and cash flow generation abilities of individual businesses once they exit this period and is where the efficacy of the measures and the health of the transmission mechanism will really be visible.

I think there is a high probability that we get a classic buy the rumour, sell the fact reopening trade. The high and continued strong retail interest in the financial markets especially the Nasdaq Exchange Traded Fund (ETF) & the record number of new brokerage accounts opened globally gives some support to my theory.

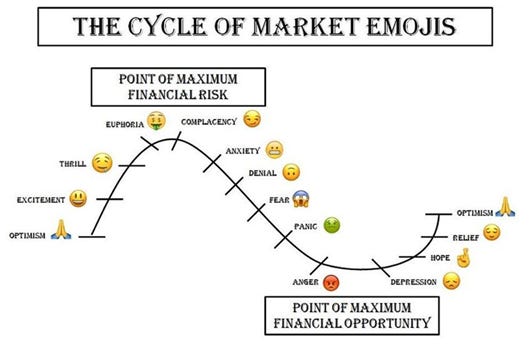

c) Intent versus Execution - To us, the market’s reaction function to central bank/government policies is likely to follow the classic cycle of market emotions through Emojis (given our new ways of working this seems more than apt).

Source: Forbes News Article Link.

We are currently somewhere in the zone of complacency and anxiety as intent of ‘whatever it takes’ has been clearly articulated by central banks and governments. The power of the intent has been apparent in the VIX (volatility) index where for the first time (so far) volatility hasn’t made another run for the highs like it has done in every prior market dislocation episode. As every CEO & business strategist knows, intent is one thing, execution is altogether another matter. The European and the Japanese experience should give us some pause for thought on the efficacy of unlimited money printing and debt driving either economic growth or financial markets. Looking at the 2008 crisis it is good to see early intent compared to then, but the scale of the ailment seems to us to be miles worse. The 2008 crisis was localized in the financial system and the mortgage lending banks, which led to problems in the real economy. Once the monetary taps restarted, bankruptcy pain was taken and everything moved a lot more smoothly and by 2010, the US banking system at least had moved forward on the path to repair leading to the longest bull market that we subsequently saw.

This time just spend a minute thinking about the problems in the wide variety of sectors we need to solve

- Retail and the impact on the high street

- Travel and tourism related (Airbnb for example)

- Airlines

- Restaurants

- Hotels

- Energy companies (given the oil price)

- Cruise Lines

- Vehicle hire companies

- Property and casualty insurance

- & of course Banks

Just in USA, together the three sectors of Retail + Leisure + Financials, i.e. sectors most impacted by the crisis account for 28% or 47 million of the total 161 million jobs (see table above).

And this is without considering other highly- Gross Domestic Profit (GDP) sensitive sectors of media, industrials and materials. Clearly the extent of the rehabilitation required is significant. (Just as trivia the FAMAGs employ c.1.3 million employees globally). In comparison the retail store JC Penney which filed for bankruptcy over this past weekend had 90,000 US employees as of its last filing).

While the announced stimulus measures (at 10% of GDP for example in USA - which I think will be the global baseline for this crisis - a number every country will need to aspire to) are significant (intent), the transmission mechanism that the stimulus reaches those most in need of it (execution) is a lot more complex.

The only profession that we are 100% confident will see unmitigated growth is likely to be that of lobbyists in Washington or Brussels.

Earnings results

One of the most common phrases we observed in sell-side research and indeed comments from our analysts as regards the 1Q2020 recent earnings season was ‘better than expected’.

Whilst withdrawing guidance, most companies and management teams have tried to paint a picture of normalcy ahead depending on the sector and exposure.

a) Some commentary of April trends stabilizing and in some cases better than March (Google, Facebook)

b) Store reopening in affected areas reopening from lockdown primarily China (Apple, Nike, other retailers)

c) Supply chains restarting and back to work (more on this below)

d) Surge in baofuxing xiaofei (revenge buying) by shoppers who had missed out on retail therapy or hair salon visits (Hermes, LVMH, Nike, various Chinese retailers)

e) Believe in the long-term growth dynamics of America (Berkshire annual meet)

f) Two years of digital transformation in two months (Microsoft),

g) Software is eating the world and data is the new oil. (Technology supply chain).

h) Surge in ecommerce leading to the need to hire (Amazon, Ocado, Walmart, Tesco)

i) Continued ability to tap the financial markets (Airbnb, cruise lines, airlines etc).

I have always believed talk is cheap, better to watch what they do. The ‘walk’ unfortunately filled us with less confidence. A few examples:

- Talk of capex discipline (Facebook, Google)

- In the fastest downturn ever, no stock buying, selling of airlines, trimming of banks (Berkshire)

- Amazon’s big surge in spending to take care of PPE and other new ways of working for new employees (worth applauding but also a sign of what any company thinking of restarting has to consider in terms of new spending to adopt new ways of working - we doubt analysts are appropriately modelling this impact in margins)

- Airbnb raised money at 10%. We have been surprised at the prices paid by many companies for their debt during this period. In our view these prices (interest rates) are not to fund growth, this is what treasurers pay for survival in a zero-rate world and explains why debt and equity issuance is now running at the highest monthly pace ever.

- It was interesting that in general, ex the Microsoft, Google, Facebook, Netflix and Apple (which are virtual monopolies in their sectors) the companies that have weathered this storm the most effectively in the markets perception (mostly in the new technology/cloud computing, biotechnology, work from home space), are not just those with high revenue growth but also include those companies where the market is not yet evaluating them on ‘earnings’ as it believes they are in the hyper growth land grab phase.

- As a final observation looking at the chart of Microsoft v/s Exxon since 1999, we wonder if there is anyone left in the world who already doesn’t know that data is the new oil and software is eating the world and has positioned themselves accordingly.

Value Chains

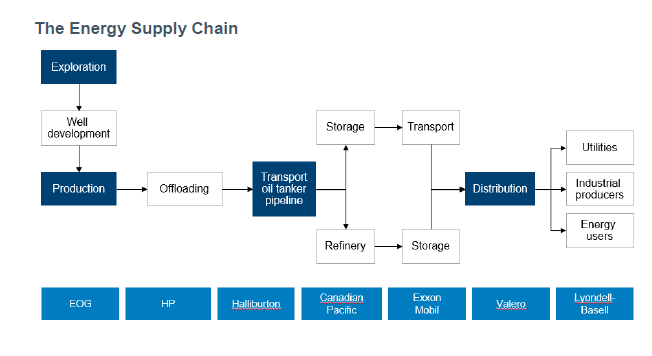

Being a global portfolio manager, one area that I spend a lot of time, (along with my sector PM colleagues) is in focusing on global supply chains and global value chains. Our belief is that the global economy is incredibly interconnected and connecting the dots on a global basis (on the back of Fidelity’s global analyst team) is an incredible source of consistent edge and investment insight for us.

Reference to specific securities should not be taken as recommendations. For illustration purposes only.

In peace time, I am generally focussed on looking for the companies with the best management teams, lowest competition and the ability to have the greatest profit share/pricing power in the value chains we are looking at. This is also our route to make the leap from micro to macro as the micro view of value chains inform our macro view of the world.

A few observations/insights:

a) The US consumer is the most important customer at the end of every global value chain. Henry Ford understood this best when he said his decision to pay his workers a good wage was not charity but a good business decision as they were as much his potential customers as they were his employees. This holds true now more than ever.

b) Given our observations above based on the Bureau of Labour statistics, the US consumer will likely go through a period of trauma and rehabilitation. Even if money is put in her pocket, it is likely that what we have observed in Japan, i.e. both consumers and corporates adding cash and investments to their balance sheet and avoiding debt would be the likely response to this crisis around the world. (Our colleague Rick Patel from our fixed income team has written an excellent note on the risk of Japanification).

c) How the consumer behaves coming out of the crisis both on the short term as well as the long term, will remain one of the biggest areas of ongoing work and influencers on both the duration and scale of the recovery.

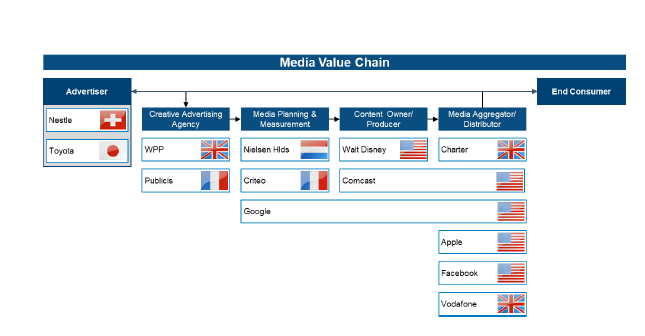

Source: (https://influencermarketinghub.com/coronavirus-marketing-ad-spend-report)

Reference to specific securities should not be taken as recommendations. For illustration purposes only.

d) The most under-researched element of any supply chain is the concept of duration - For example it takes about 45 to 60 days to ship anything from one part of the world to another (hence the focus on three-month forward prices in most commodities). Further, the way companies work, revenue growth and cash positions in one quarter/year impact the business decisions of the next quarter/year. So when Coke, Hilton, Nestle or Toyota decide to reduce spending this will impact future quarters more than the current quarter (this is especially important when we consider advertising driven business models like Disney, Facebook or Google).

e) For most businesses, most expenses are fixed in the short term but discretionary in the long term. Thinking through the CFO’s mindset in the current environment

i. Stage 1 - protect the balance sheet (raise debt/ equity capital)

ii. Stage 2 - cut all discretionary expenditure (new hiring, marketing budget for 3Q/4Q)

iii. Stage 3 - cut all future capex expenditure

iv. Stage 4 - look at revenue versus past expectations and recalibrate budgets

f) What most forget (which Henry Ford recognized brilliantly), is the reflexive impact that their decisions during stages 1 to 3 will have on stage 4. This is precisely what government stimulus tries to solve by repeated adrenaline shots to the economy so that individual consumer/corporate behaviours don’t drive a negative spiral for the collective.

g) Based on the above, it is our view that on average, consensus earnings estimates still remain too high for 2H2020 and FY2021. With market multiples also above long-term averages, the margin of safety feels less alluring over the short to medium term v/s what it did in March.

h) Taking this to a wider global scale, while it would seem to many that China has navigated this period brilliantly, micro thinking would suggest that, if China is indeed the manufacturing hub of the world, they are yet to see the reverberations of the western world shut down. This lies ahead and will happen when chief operating officers look at their revenue projections for the key Christmas quarter and start withdrawing/cutting orders. Better a missed sale rather than a working capital build-up or unsold inventory if the virus makes a return in winter.

i) And how this corporate behaviour manifests itself over the next two quarters will also give us a sense of that trillion-dollar inflation versus deflation question. Simply put If they cut orders too far relative to demand - we have deflation first (less money going around for goods) and then inflation (as we saw with toilet paper and hand sanitizers). The scenario that remains a live possibility is stagflation which for equity markets is the worst of all worlds. The scale of the fiscal/monetary response would suggest that we should park that depressing thought for now.

Reference to specific securities should not be taken as recommendations. For illustration purposes only

j) One last comment on value chains. Energy and oil are what power everything. In our view, oil (given that for now central bankers are not involved in its price setting) remains the best gauge of the health of the global economy and oil demand, the best real time indicator of how both the consumer and businesses emerge from this lockdown.

k) Given the complexity of the problems that lie ahead, for now everyone (central banker to CEO to CFO) is only speculating. Machines don’t have the data and humans don’t have the compute power to navigate this. We can only adjust in real time while continuing to think about the long-term implications of these changes.

The Virus, the Consumer and other Unanswered questions?

When the vaccine will be available is probably the most important question for all of us personally and it is the one which the markets are singularly focussed on. Given the amount of both financial and intellect.

Disclaimer

The views and content presented on this website are my own and are shared in a personal capacity, and do not necessarily reflect the views of Arteqin Capital Limited. References to my prior professional roles are provided solely for context. Certain articles or materials referenced here may have originally been developed during my tenure as a Portfolio Manager at Fidelity. To the extent such works have been developed during my tenure at Fidelity, all copyrights and other intellectual property rights in those works remain the property of Fidelity or its affiliates.

No content on this site should be construed as representing the views, policies, or positions of Fidelity or any other past or present employer.

This content is made available for informational and educational purposes only. All opinions and information are as of the time of publication and may be subject to change. The views expressed do not consider the specific investment objectives or other circumstances of any person. No representation or warranty is made as to the accuracy, fairness or completeness, and no obligation is assumed to update, supplement or correct any opinion or information. Nothing herein constitutes investment (or other) advice or a recommendation relating to, or an offer, or solicitation of an offer, to acquire or dispose of, any security, instrument, commodity, derivative, investment management service, or financial product. Accordingly, no reliance shall be placed on this content when making an investment decision or engaging in any investment activity and independent expert legal, financial, tax and other professional advice should be sought and independent judgement exercised before any such decision or activity. All investments involve a high degree of risk, including possible loss of all or a significant portion of the investment. Nothing herein shall be interpreted as a guarantee that any forecasts or opinions will materialise. Past performance is not a reliable indicator of future results. This content is intended only for persons who are permitted to receive the same in accordance with applicable laws and has not been approved by any regulatory or supervisory authority. Nothing herein shall create any responsibility or liability for any loss or damage suffered or incurred, directly or indirectly, from any use of this content or impose any obligation to proceed with any transaction.

If you publish or otherwise disclose this content, please disclose the source as [Amit Lodha of Arteqin Capital.]